Edward Mitchell is 34 years old and lives in Jackson, Tennessee, with a spinal cord injury caused by a hit-and-run accident that happened when he was 17. He has plenty of expenses that all Americans have, like groceries and utilities. But to maintain his independence, he also has to pay for home modifications to accommodate his wheelchair, personal nursing care, dictation tools to help him write and adjustments to his car so he can drive himself to work.

He is just one of the 20 million working-age adults living with disabilities in the U.S., for whom it takes more money to make ends meet because of the additional expenses they face every day.

In a recent working paper published with the National Disability Institute, a nonprofit organization that works to build a better financial future for people with disabilities and their families, we estimated the amount of extra costs associated with living with a disability for Americans ages 18 to 69 years old.

Using data from four nationally representative surveys, we found that adults with disabilities require, on average, 28% more income to achieve an identical standard of living as a household of the same size and income where no one has disabilities—and that’s on top of what is already covered and provided by government programs offering disability benefits. At the median U.S. income level, that amounts to an additional US$17,690 per year.

Each person’s exact costs are likely to vary depending on which disabilities they have and what specific expenses they face.

Why this matters for how we measure poverty

For people like Edward, it takes more income to achieve the same standard of living as a person without a disability. Yet, the federal poverty guidelines do not take these additional costs into account. This is important because these guidelines are used to determine financial eligibility for many social welfare programs.

Treating his income as the same as a person without a disability ignores the fact that a significant percentage of his earnings are devoted to expenses related to his disability.

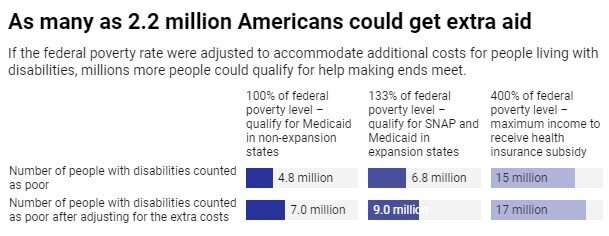

We estimate that, if the federal poverty guidelines took into account these extra costs, as many as 2.2 million more people with disabilities would be counted as poor and become eligible for programs like health care and food assistance that people depend on for their basic needs.

What could be done?

There is ample precedent for adjusting income figures when determining whether a family is below, at or above the federal poverty level. This is automatic, for instance, based on family size: Larger families can earn more money than smaller ones, and still remain eligible for various benefits.

It objectively costs more to raise a family of four than a family of three. The same is true for people with disabilities. Income eligibility guidelines for programs such as housing assistance and medical insurance—all of which are already adjusted for family size—could also be adjusted to compensate for the extra costs of disability.

Such an adjustment would be in line with current U.S. policies that already recognize these extra costs. For example, to receive food assistance, a household of three cannot earn more than $2,353 a month and cannot have cash assets greater than $2,250. However, if the household has a member with a disability, the household can have assets up to $3,500.

Another option would be to create a disability living allowance program that helps cover the unavoidable costs of living with a disability. At present, U.S. disability support programs only provide benefits if the person can prove that they are unable to work for a year or longer. This means that millions of people with disabilities who can work are provided no support for their extra costs of living.

Source: Read Full Article